PH BIR 2316 2021-2024 free printable template

Show details

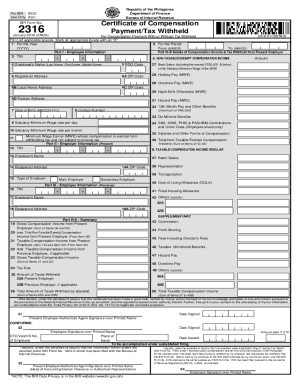

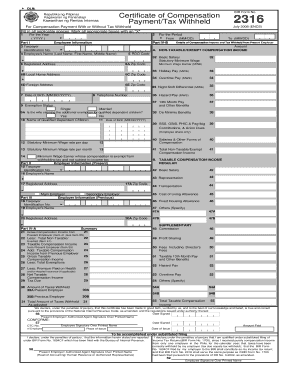

For the calendar year that taxes have been correctly withheld by my employer tax due equals tax withheld that the BIR Form No. 1604CF filed by my employer to the BIR shall constitute as my income tax return and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 had been filed pursuant to the provisions of RR No. 3-2002 as amended.. DLN Certificate of Compensation Payment/Tax Withheld Republika ng Pilipinas Kagawaran ng Pananalapi Kawanihan ng Rentas Internas July 2008...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bir form 2316 2021-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 2316 2021-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bir form 2316 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2316 bir form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

PH BIR 2316 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out bir form 2316 2021-2024

How to fill out bir form 2316:

01

Obtain a copy of bir form 2316 from the official website of the Bureau of Internal Revenue.

02

Fill out the taxpayer's information section, including your full name, taxpayer identification number (TIN), registered address, and contact details.

03

Provide details of your employer, such as their name and TIN, as well as their registered address.

04

Indicate your employment details, including your position and nature of work, the period covered by the form, and the type of establishment or industry you are employed in.

05

State your exemptions, deductions, and fringe benefits received, if applicable.

06

Compute your tax due or refundable using the guidelines provided within the form.

07

Sign and date the form, and make sure that your employer signs and stamps it as well.

08

Submit the completed form to your employer for their records and for them to file it with the BIR.

Who needs bir form 2316:

01

Employees working under an employer who is required to withhold taxes are required to have a bir form 2316.

02

It is necessary for individuals who receive purely compensation income and do not have any other taxable income or deductions.

03

Those who wish to claim exemptions, deductions, or refundable amounts on their income tax return must submit a bir form 2316 to support their claims.

Fill bir 2316 form pdf : Try Risk Free

What is bir form 2316?

What is BIR Form 2316? ... BIR Form 2316 is completed and issued to each employee that receives a salary, wage or any other form of remuneration from the employer. The Certificate should identify the total amount of compensation paid to, and the total taxes withheld from, each employee during the previous calendar year.

People Also Ask about bir form 2316

How can I get ITR 2316 in the Philippines?

How is tax refund computed in the Philippines?

How many percent is the income tax return in Philippines?

How do I download EBIR forms?

Who are exempted from tax in the Philippines?

How do tax refunds get calculated?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bir form 2316?

BIR Form 2316 is a withholding tax certificate issued by the government of the Philippines. It is used to document the amount of tax withheld from employees' wages by employers, and is typically required for tax filing purposes.

Who is required to file bir form 2316?

Employers are required to file BIR Form 2316 to report the amounts of income tax deducted from the salaries of their employees.

How to fill out bir form 2316?

1. Start by entering your name, address, and contact information.

2. Enter your employer’s name, address, and contact information.

3. Enter your TIN (Tax Identification Number).

4. Enter the total amount of compensation received from your employer for the current year.

5. Enter the total amount of deductions and contributions made to the government for the current year.

6. Enter the total amount of taxes withheld by your employer for the current year.

7. Enter the total amount of taxes due to the government for the current year.

8. Sign and date the form.

9. Submit the form to the Bureau of Internal Revenue.

What is the purpose of bir form 2316?

Bir Form 2316, officially known as the Certificate of Compensation Payment/Tax Withheld, is a form used to document the withholding tax on the salaries, wages, and other forms of compensation paid to an employee of a company. It is used to report the employee’s taxable income and the taxes withheld from that income. The form also serves as proof of payment for the employee's income taxes.

What information must be reported on bir form 2316?

Form 2316 is an income tax return form for employees that provides details about their taxable income, withholding tax, and contributions to the Social Security System (SSS). The information required on Form 2316 includes:

• Employee Name and SSS Number

• Employer Name and Tax Identification Number (TIN)

• Employee’s Gross Income

• Employee’s Taxable Income

• Withholding Tax

• Contributions to SSS, PhilHealth, and Pag-IBIG

• Taxable Fringe Benefits

• Tax Credits/Payments

• Net Taxable Income

• Tax Due

• Tax Withheld

When is the deadline to file bir form 2316 in 2023?

The deadline to file BIR Form 2316 in 2023 is on or before April 15, 2024.

What is the penalty for the late filing of bir form 2316?

The penalty for the late filing of BIR Form 2316 is a minimum penalty of P1,000 or a maximum penalty of P25,000.

How do I execute bir form 2316 online?

Easy online 2316 bir form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit bir 2316 form online?

The editing procedure is simple with pdfFiller. Open your bir 2316 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete bir form 2316 download on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 2316 form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your bir form 2316 2021-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir 2316 Form is not the form you're looking for?Search for another form here.

Keywords relevant to itr 2316 form

Related to 2316

If you believe that this page should be taken down, please follow our DMCA take down process

here

.