PH BIR 2316 2021-2026 free printable template

Show details

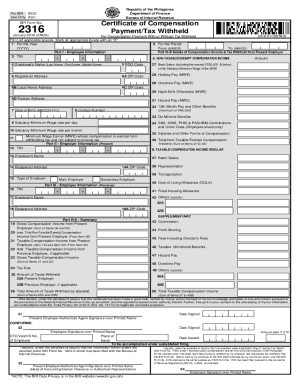

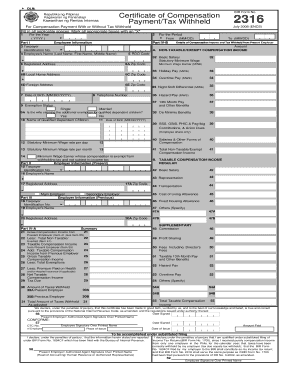

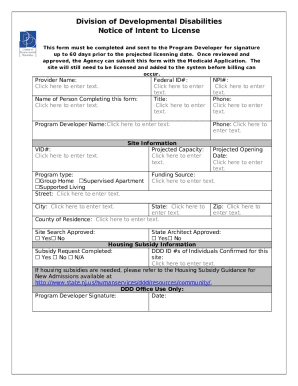

For the calendar year that taxes have been correctly withheld by my employer tax due equals tax withheld that the BIR Form No. 1604CF filed by my employer to the BIR shall constitute as my income tax return and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 had been filed pursuant to the provisions of RR No. 3-2002 as amended.. DLN Certificate of Compensation Payment/Tax Withheld Republika ng Pilipinas Kagawaran ng Pananalapi Kawanihan ng Rentas Internas July 2008...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir form 2316

Edit your bir 2316 form download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir 2316 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bir form 2316 download online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2316 bir form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 2316 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out bir 2316 form

How to fill out PH BIR 2316

01

Obtain a blank PH BIR Form 2316 from the Bureau of Internal Revenue (BIR) website or from your employer.

02

Fill in the basic information, including the certificate's date and the employer's information.

03

Provide the full name, Tax Identification Number (TIN), address, and other personal information of the employee.

04

Indicate the period covered by the certificate and the amount of compensation received.

05

Fill in the details of taxes withheld from the employee's compensation.

06

Have the employer or authorized representative sign and date the form.

07

Submit the completed PH BIR Form 2316 to the appropriate BIR office if required.

Who needs PH BIR 2316?

01

Employees who receive compensation from an employer and are subject to income tax.

02

Employers who need to report the income tax withheld from their employees.

03

Individuals applying for loans, credit, or other financial services that require proof of income.

04

Taxpayers who need to file their annual income tax returns.

Fill

2316 form

: Try Risk Free

What is bir form 2316?

What is BIR Form 2316? ... BIR Form 2316 is completed and issued to each employee that receives a salary, wage or any other form of remuneration from the employer. The Certificate should identify the total amount of compensation paid to, and the total taxes withheld from, each employee during the previous calendar year.

People Also Ask about form 2316 download

How can I get ITR 2316 in the Philippines?

How to get BIR Form 2316. You can download an unfilled pdf copy from the BIR website. However, you can as well as receive it from your employer. Depending on the number of companies you have worked for, each one of them should issue you with this particular document.

How is tax refund computed in the Philippines?

It is an annual payback to employees who have paid excess taxes during the BIR fiscal year. The amount of the income tax refund is based on the employees' annual gross income. It is shown on the Certificate of Compensation Payment/Income Tax Withheld (or BIR Form 2316).

How many percent is the income tax return in Philippines?

The Philippines implements a progressive personal income tax rate of up to 35 percent.

How do I download EBIR forms?

0:49 4:40 How to Download and the eBIRForms App - YouTube YouTube Start of suggested clip End of suggested clip Click the link to download the most updated version of the ebir forms package. Wait for the packageMoreClick the link to download the most updated version of the ebir forms package. Wait for the package to completely download. And then click on the zip file to open it.

Who are exempted from tax in the Philippines?

A resident alien, non-resident citizen, or non-resident alien involved in business or practice of profession within the country, or. A trustee of a trust engaged in trade or business. A guardian of a minor engaged in trade or business.

How do tax refunds get calculated?

Simple Summary. Every year, your refund is calculated as the amount withheld for federal income tax, minus your total federal income tax for the year. A large portion of the money being withheld from each of your paychecks does not actually go toward federal income tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute bir form 2316 editable online?

Easy online download bir form 2316 july completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit bir form 2316 downloadable form online?

The editing procedure is simple with pdfFiller. Open your itr form 2316 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete 2316 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your bir form 2316 w2 1701, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is PH BIR 2316?

PH BIR 2316, also known as the Certificate of Compensation Payment/Tax Withheld, is a document issued by employers to their employees in the Philippines, indicating the total compensation paid during the year and the income tax withheld by the employer.

Who is required to file PH BIR 2316?

Employers are required to file PH BIR 2316 for their employees who receive compensation income, particularly those whose income is subject to withholding tax.

How to fill out PH BIR 2316?

To fill out PH BIR 2316, employers need to provide the employee's information such as name, Tax Identification Number (TIN), and the total compensation paid during the year. They also need to report the tax withheld and validate the document with the employer's details.

What is the purpose of PH BIR 2316?

The purpose of PH BIR 2316 is to serve as proof of income and taxes withheld for employees. It is used by employees when filing their annual income tax returns and ensures compliance with tax regulations.

What information must be reported on PH BIR 2316?

The information that must be reported on PH BIR 2316 includes the employee's name, TIN, gross compensation income, total tax withheld, employer's name, employer's TIN, and the period of payment.

Fill out your PH BIR 2316 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2316 Forms Download is not the form you're looking for?Search for another form here.

Keywords relevant to 2316 form editable download

Related to 2316 editable form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.